City of Cincinnati Property Tax Relief Program

|

|

For many low to moderate income households, property taxes can account for a significant portion of their monthly expenses, making it difficult to afford basic necessities such as food, housing, and healthcare. Property tax relief programs can help to reduce the risk of homelessness and financial instability for low income families, ultimately promoting a more equitable and sustainable society.

Ohio property taxes were reassessed last year and many homeowners saw a significant increase in these taxes. For individuals and families that were already behind on their property taxes, this increase significantly increased the burden. The increase in property taxes also significantly increased the number of Hamilton County homeowners who have fallen behind on their property taxes.

To reduce the risk of homelessness and financial instability to these individuals and families, The City of Cincinnati is administering a property tax assistance program, called the HomeSafe Property Tax Relief Program. The program is for low-to-moderate-income homeowners who are delinquent on their property taxes. Eligible homeowners can apply to receive up to $10,000 toward property taxes that are past due, going back as far as the year 2020.

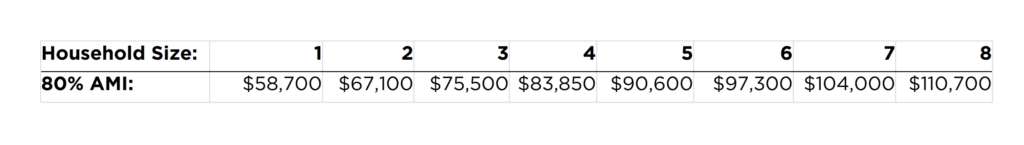

Eligibility requirements are the following: 1) The household income must be 80% or lower than the Area Median Income (see chart below); 2) The property has to be in Cincinnati; 3)The property must be the primary residence of the applicant; and 4) The property taxes on the residence must be past due.

Applications will be processed on a first-come, first-served basis prioritizing the following groups: 1) Senior citizens who have a fixed income; 2) Homes with dependent children; and 3) Homeowners who live in “LIFT” neighborhoods. For those who don’t know, LIFT is an employment assistance program. A LIFT Program application is available on the Freestore website.

There is a fillable pdf of the application which can be submitted by email. Alternatively one can print the application, complete it by hand, and turn the application in person at the Department of Community & Economic Development, located at 805 Central Avenue, Suite 700. Applications for the tax relief program when received can take up to 15 days to be processed. More information can be found on the program website.

You can find more housing and financial resources by selecting the “Housing” and or “Financial Resources” category tab on our Social Service “Utilization Library” page.