Navigating the Health Insurance Marketplace

|

|

The Health Insurance Marketplace is an online tool to investigate and select the best medical health insurance plan for your situation. All the options available in the Health Insurance Marketplace are ACA compliant. “ACA compliant” means that the insurance plan follows the rules of the Affordable Care Act, which was passed by Congress in 2010. These rules were in part meant to protect individuals and families from being taken advantage of by insurance companies. ACA-compliant plans can NOT discriminate against individuals with preexisting medical conditions, and MUST cover both minor and major medical issues. You are not required to get your health insurance from the Health Insurance Marketplace, it is just a tool to help you get the best insurance for your situation.

This year’s deadline to get health insurance that is compliant with the Affordable Care Act (ACA) is January 15th, 2026. Every year there is a period of time set aside for individuals and families to either renew or sign up for ACA-compliant health insurance. This period of time is called “open enrollment”. Open enrollment this year is from November 1st 2025 until January 15th 2026 (actually, the deadline is December 15th if you need your health insurance to be active on the 1st of the new year). If you miss the deadline and do not qualify for an exception, then you will either have to wait until November 2026 to get health insurance, or get a non-ACA compliant heath insurance plan until then. Exceptions are granted if you’ve had certain life events, including losing your job’s health coverage, moving, getting married or divorced, having a baby or adopting a child, or a death in the family. You are typically allowed to enroll for a new ACA compliant health plan up to 60 after such an event.

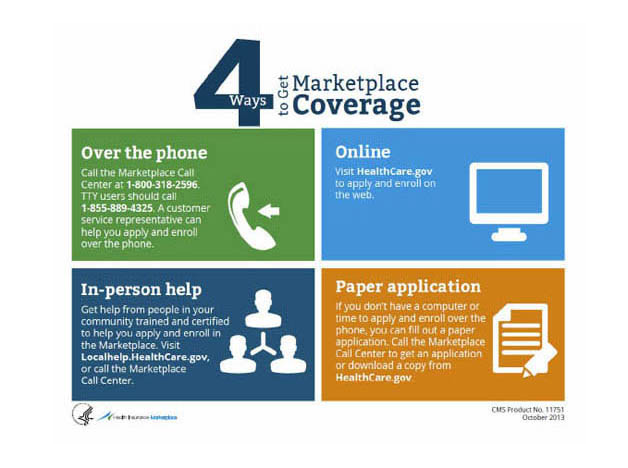

If you need help selecting a plan for 2025, there are trained and certified individuals who can help you enroll in a Marketplace plan and are required to provide fair, impartial and accurate information. To set up a time to talk in-person, over the phone, or by email with one of these individuals, there is an online portal you can use to find one of these individuals in your area.

Sometimes individuals and families are interested in changing insurance providers because they feel they have been treated unfairly by their current insurance provider. Open enrollment is the best time to make that change. Ohio law also gives you the right to file a complaint against insurance companies, health maintenance organizations (HMOs), insurance agents and adjusters. You can view more information about filing a complaint, and the Ohio agency in charge of protecting consumers from unlawful health insurance practices at insurance.ohio.gov

Ohio Medicaid Recipients

Please note that if you are an Ohio Medicaid recipient the deadlines listed in this article do not directly apply to you. While you must fill out a new Medicaid application every year to stay in the Medicaid program, the timing of this does not correspond to the open enrollment period of private insurance marketplace. If you have a current Ohio Medicaid provider the Ohio Department of Job and Family services, or your local county office, will contact you when it is time for re-determination of your eligibility. As an Ohio Medicaid recipient, you do still have a choice of which Medicaid provider you use, and may switch your coverage during the open enrollment period by contacting the provider to which you wish to switch. No action is needed if you wish to stay with your current Ohio Medicaid provider. The following is a list of Medicaid providers from which you may choose in the State of Ohio.

AMERIHEALTH CARITAS OHIO via website, or by phone at (833) 764-7700;

ANTHEM BLUE CROSS AND BLUE SHIELD via website, or by phone at (844)912-0938; the

BUCKEYE HEALTH PLAN via website, or by phone at (866) 246-4358;

HUMANA HEALTHY HORIZONS IN OHIO via website, or by phone at (877) 856-5702;

MOLINA HEALTHCARE OF OHIO via website, or by phone at (800) 642-4168;

UNITED HEALTHCARE COMMUNITY PLAN OF OHIO via website, or by phone at (800) 895-2017; or the

CARESOURCE via website, or by phone at (800-324-8680).

You can find more resources related to primary health care by selecting the “Primary Medical Care” category tab on our Social Service “Utilization Library” page.